IRS library

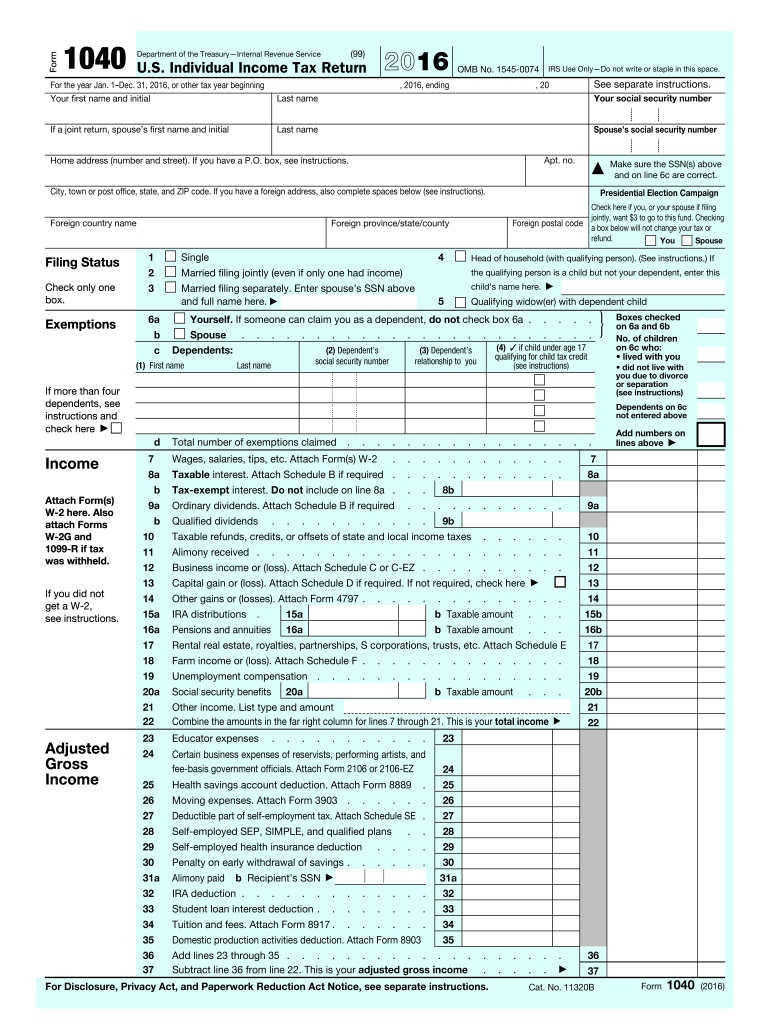

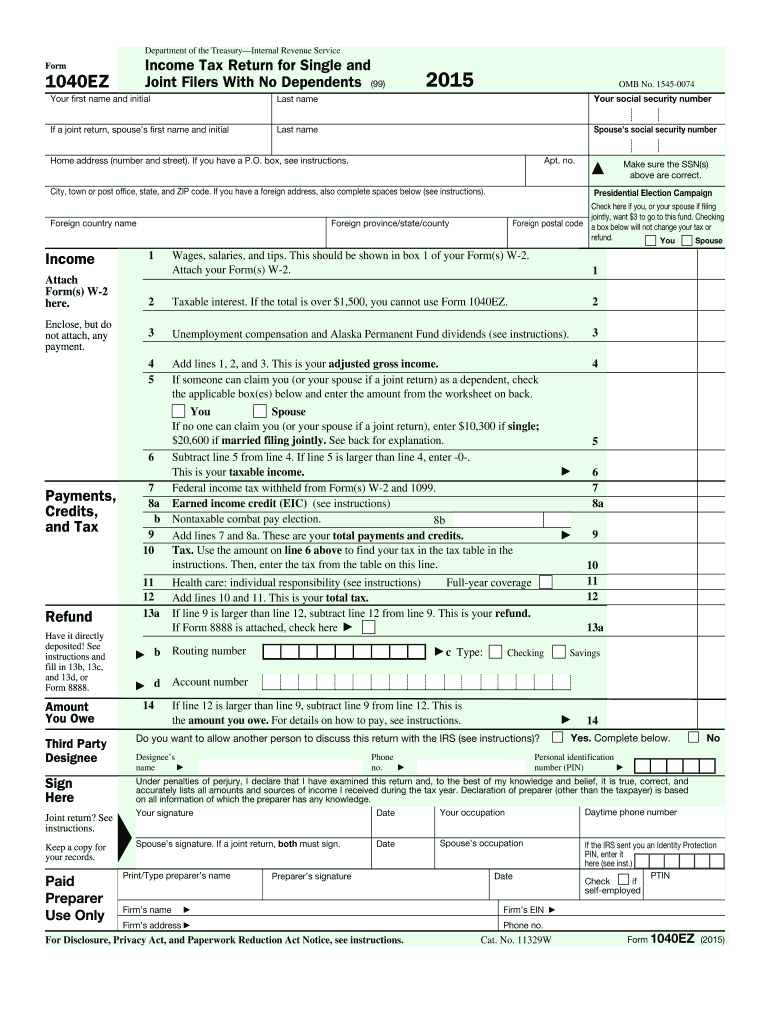

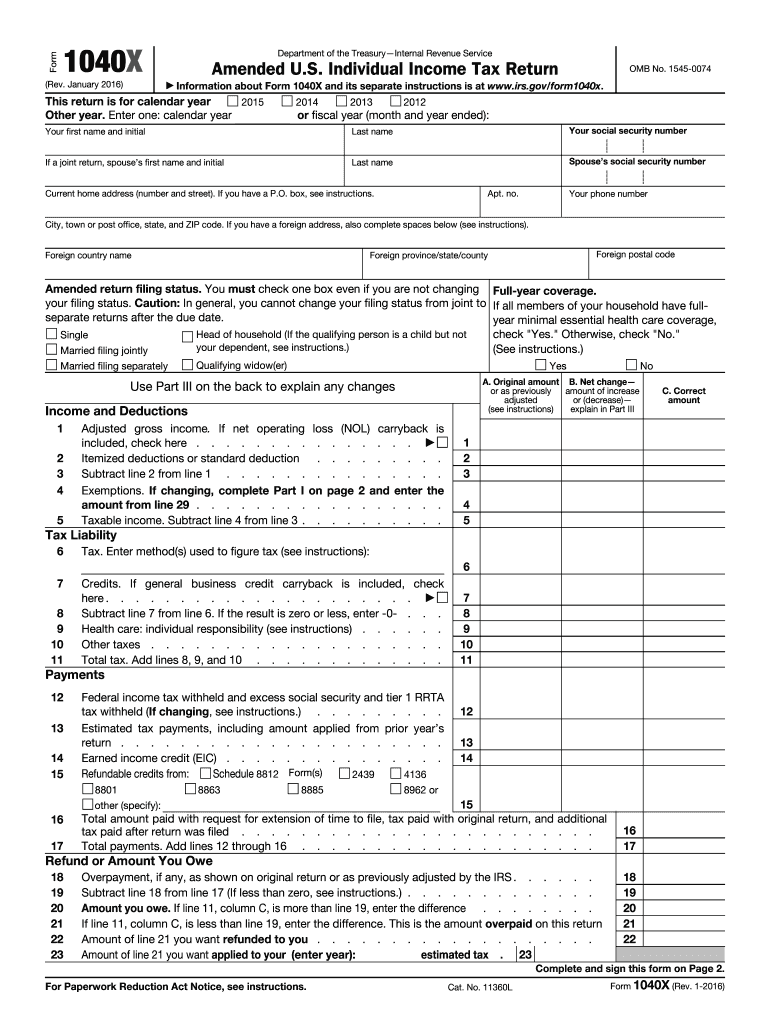

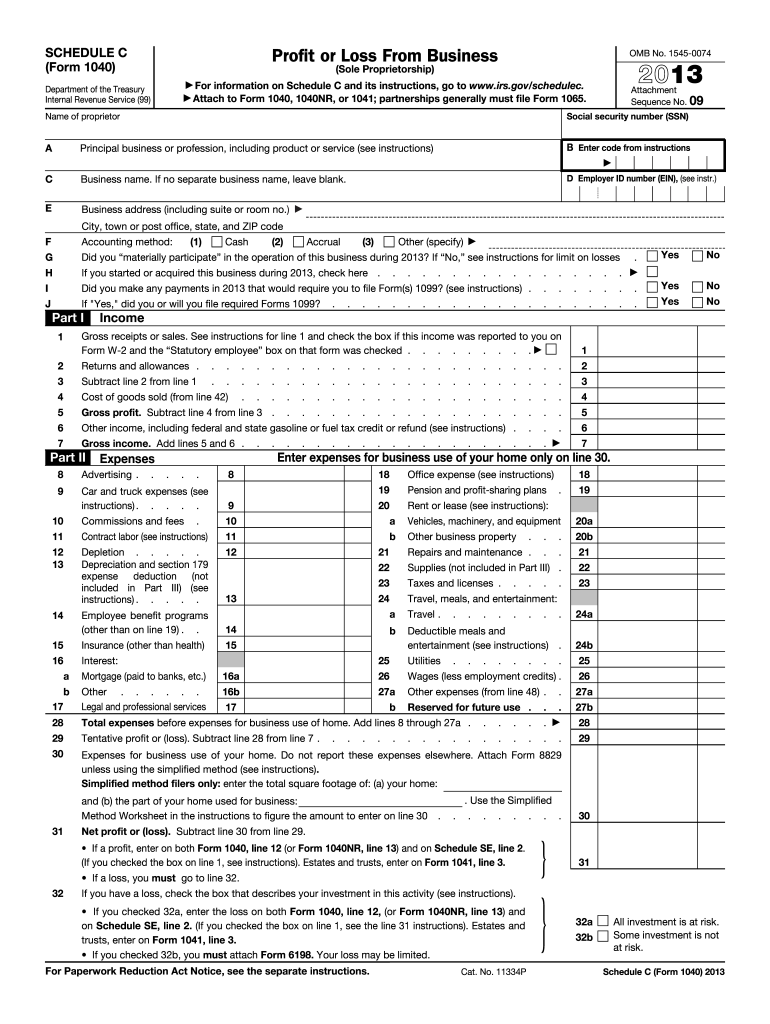

1040 forms

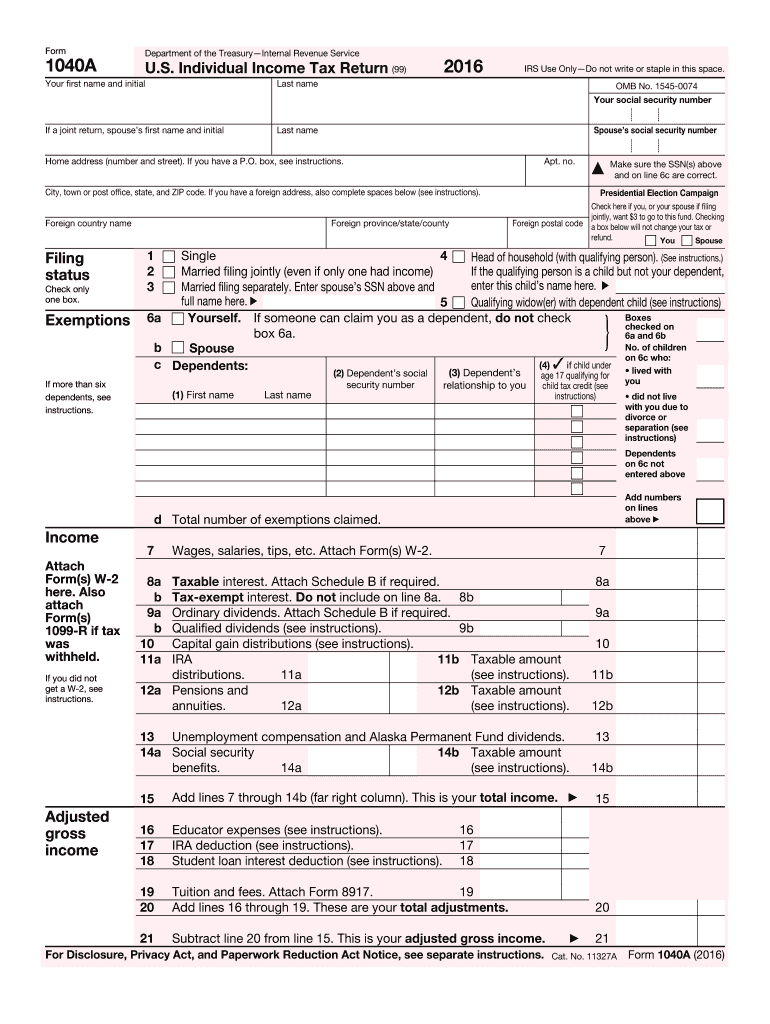

1040-A form

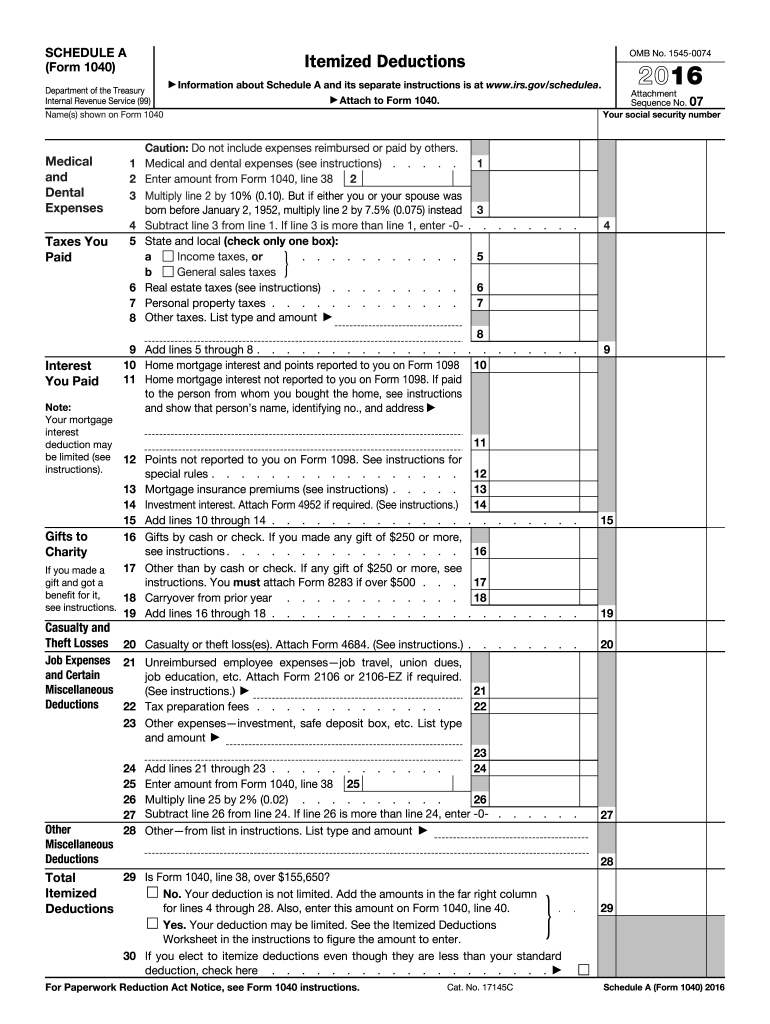

Individuals who have varied incomes and would like to take various deductions can file this form

Learn more

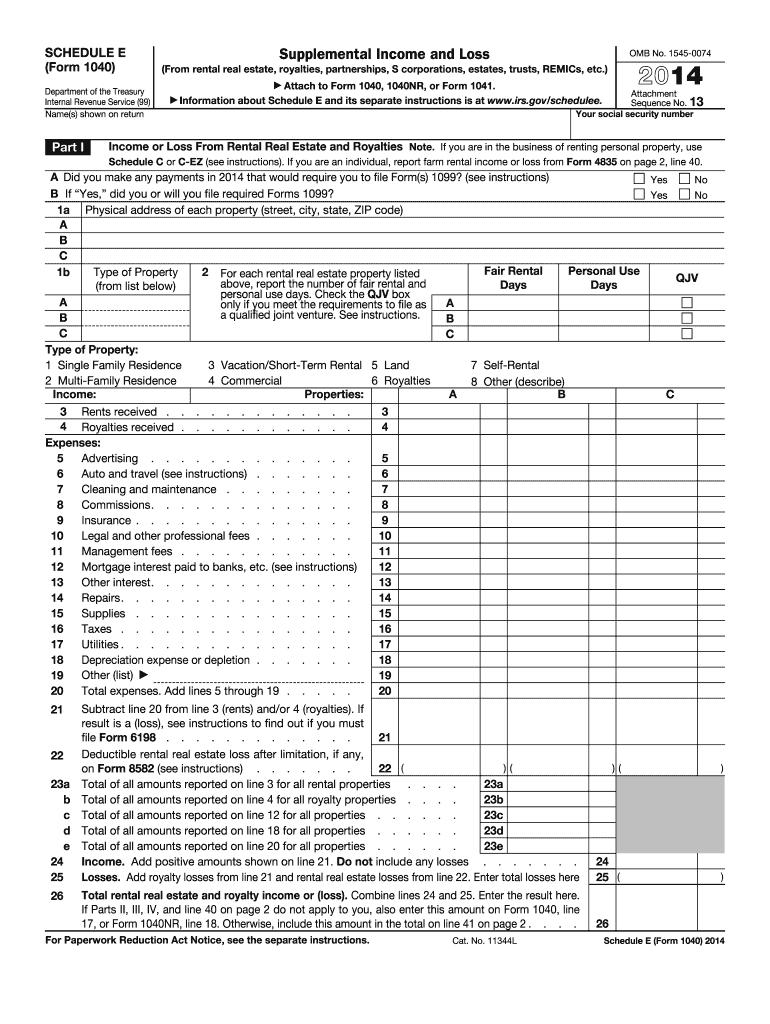

Schedule E (1040 form)

Use this schedule to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

Learn more

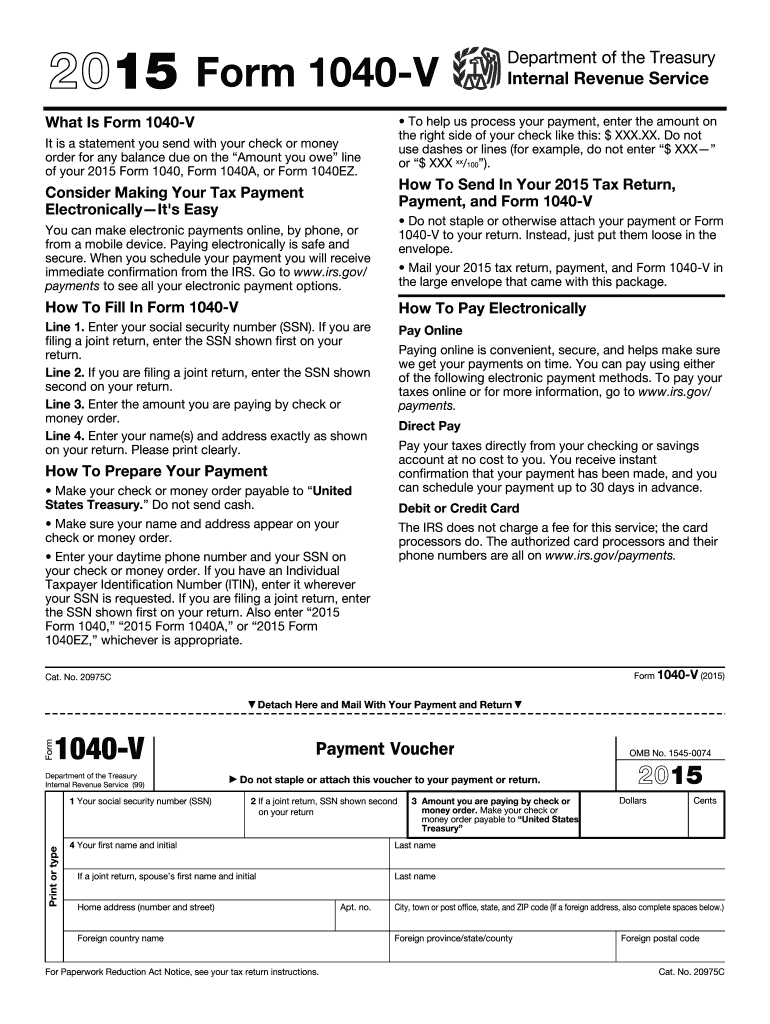

1040-V form

The Payment Voucher for Form 1040 is a statement you send with your check or money order for any balance due on the “Amount you owe” line of your Form 1040, Form 1040A, or Form 1040EZ.

Learn more

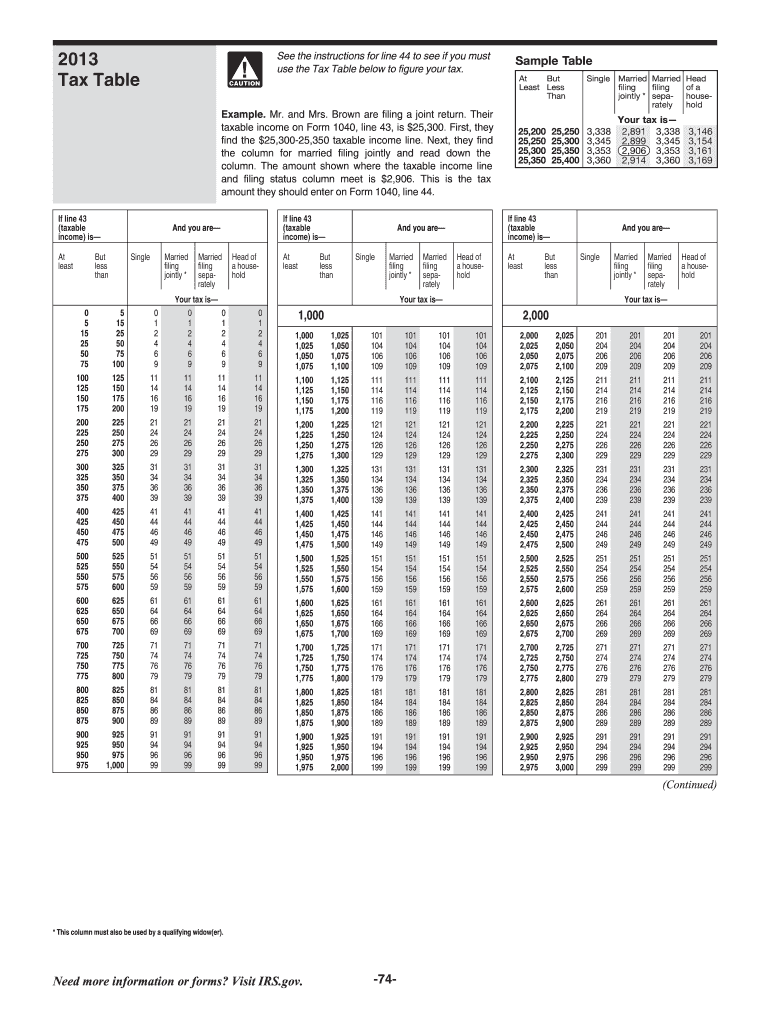

1040 Tax Table form

This booklet contains Tax Tables from the Instructions for Form 1040 only.

Learn more

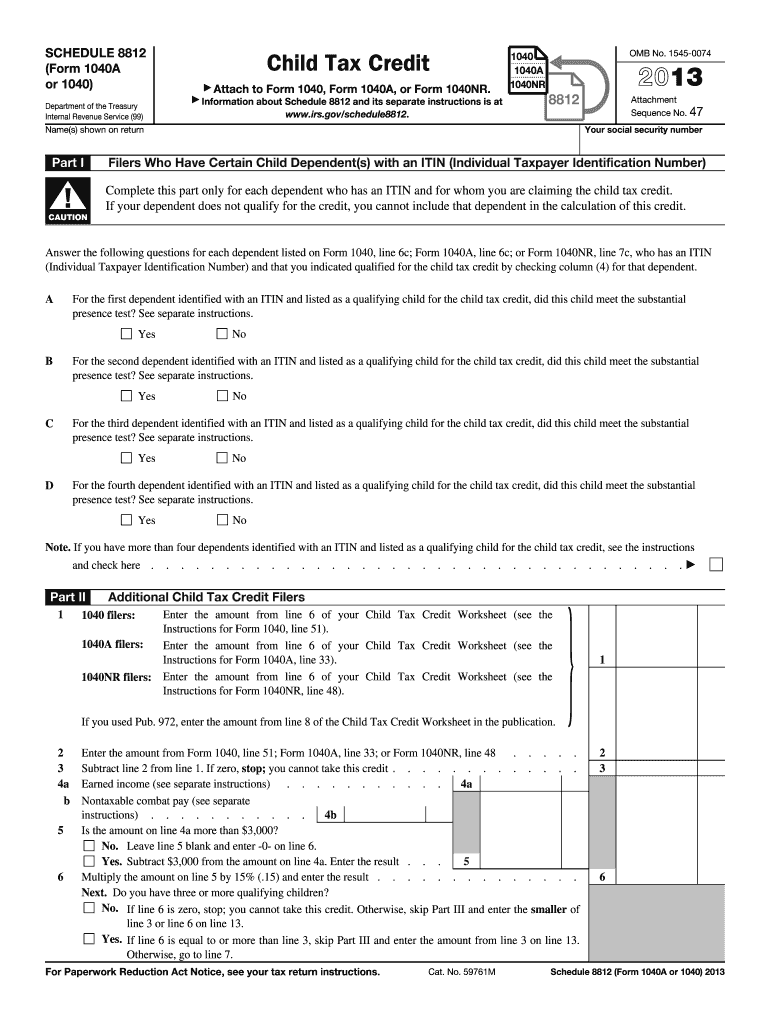

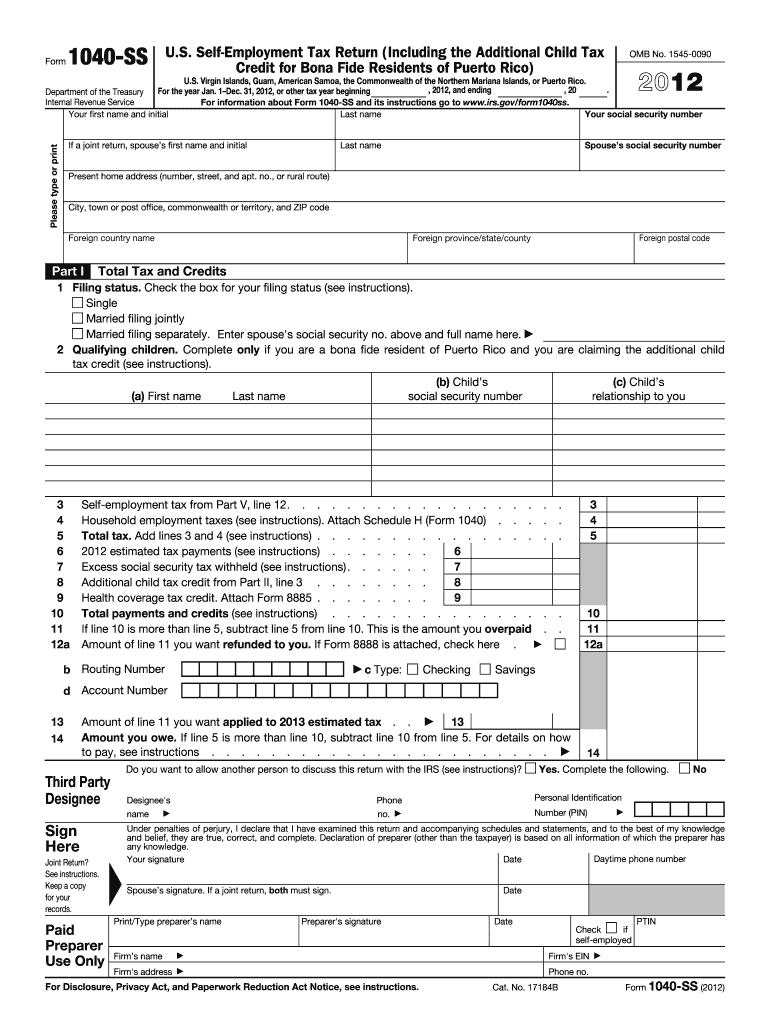

1040-SS form

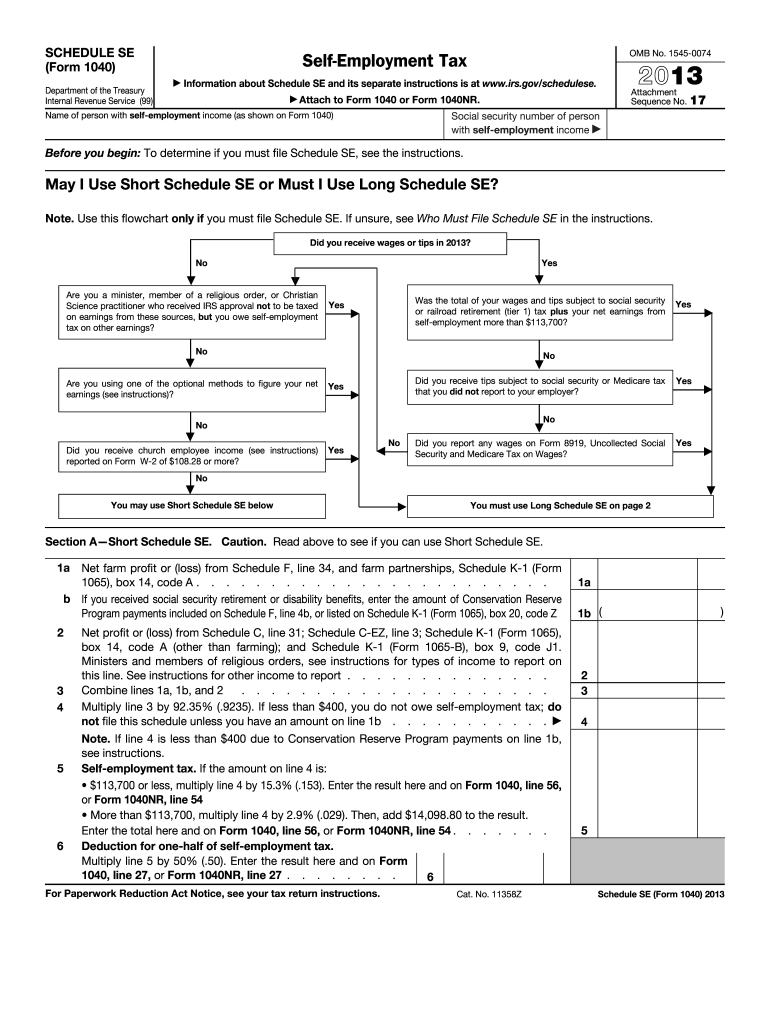

U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

Learn more

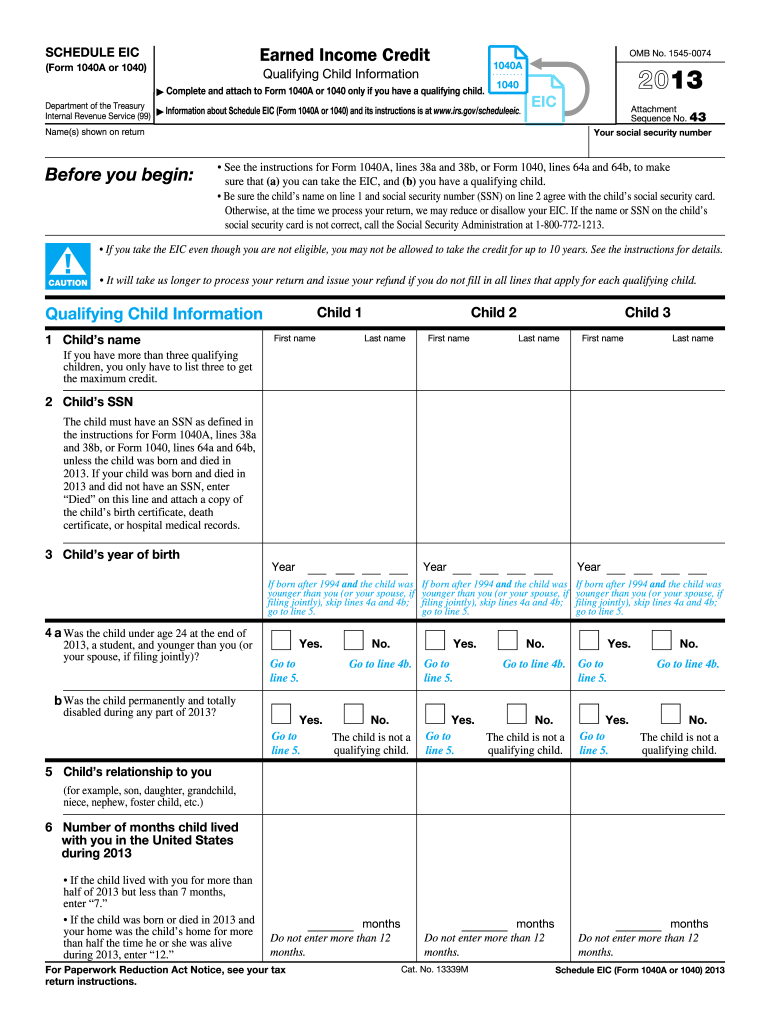

Schedule EIC (1040 form)

Earned Income Credit. After you have figured your earned income credit (EIC), use this schedule to give the IRS information about your qualifying child(ren).

Learn more

-

1

- 2