IRS library

Other tax forms

2553 forms

Election by a Small Business Corporation is used when small businesses decide to be taxed as a "Subchapter S - Corporation"

Learn more

2555 forms

Foreign Earned Income is filed by taxpayers who have earned income from sources outside the United States exempt from U.S. income tax

Learn more

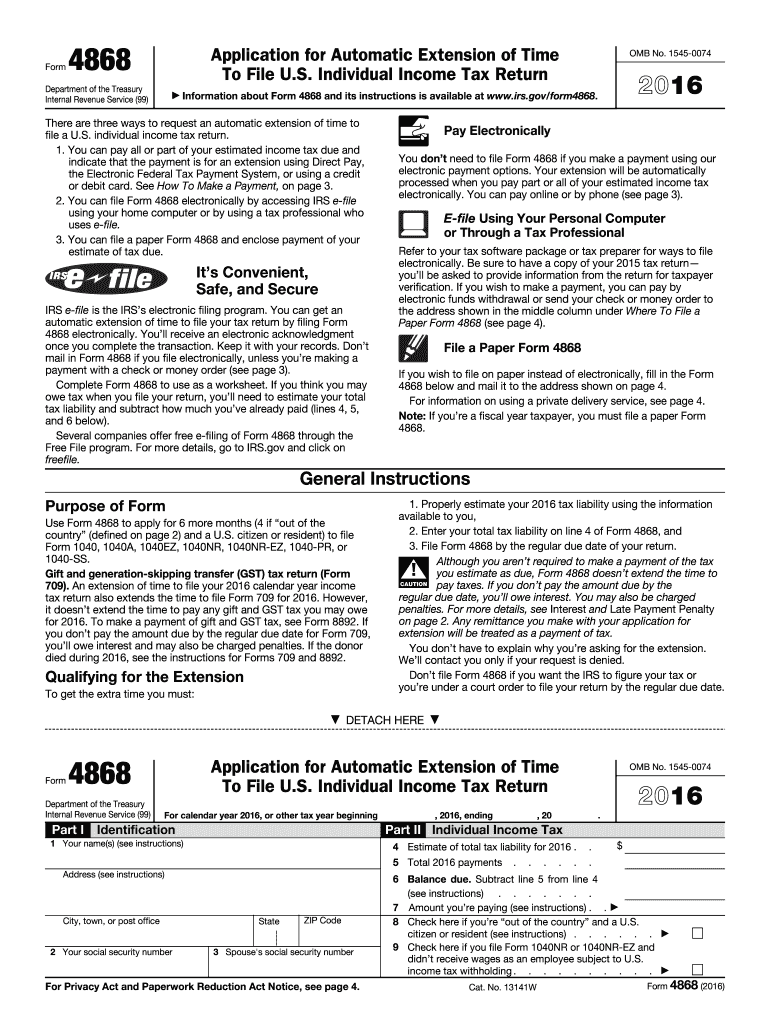

4868 form

Application for Automatic Extension of Time To File U.S. Individual Income Tax Return is used to postpone filing a return, not paying the tax

Learn more

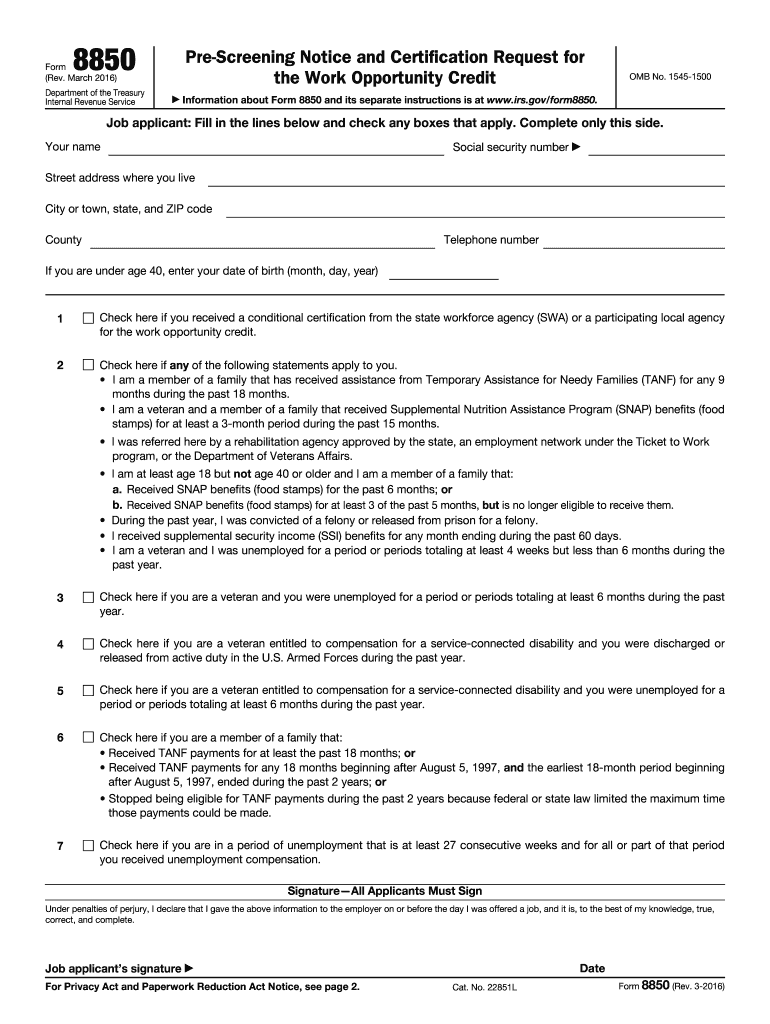

8850 form

Pre-Screening Notice and Certification Request for the Work Opportunity Credit is requested according to Work Opportunity Tax Credit program.

Learn more

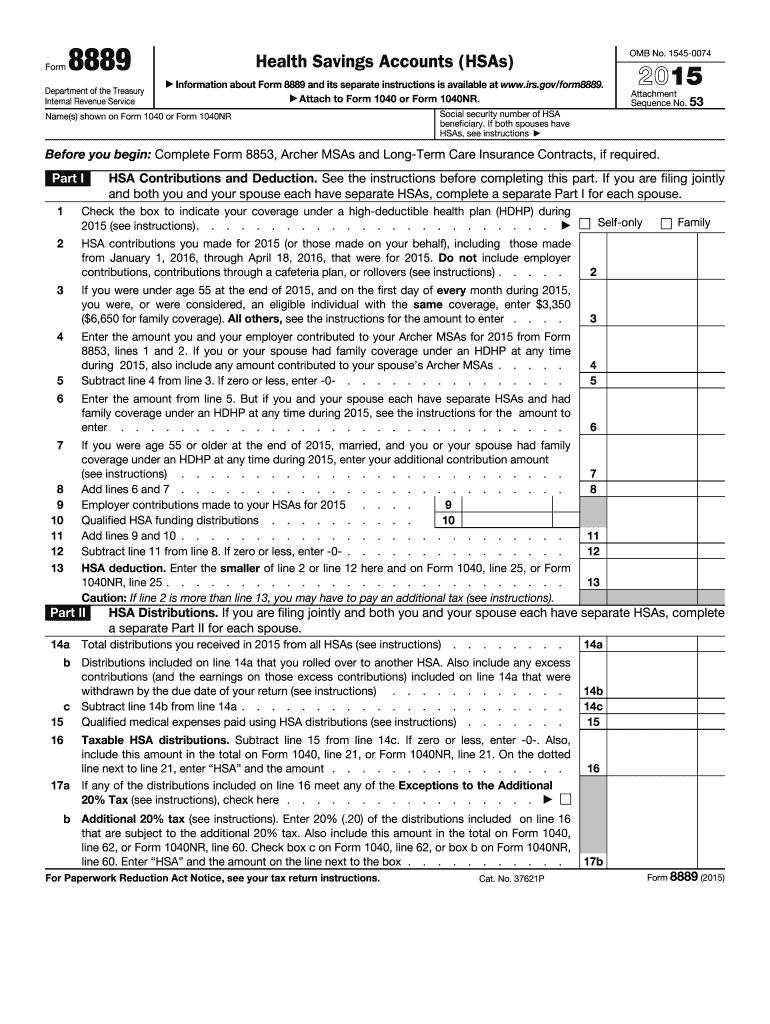

8889 form

Health Savings Accounts (HSAs) is used by account holders to report changes on their accounts to IRS

Learn more

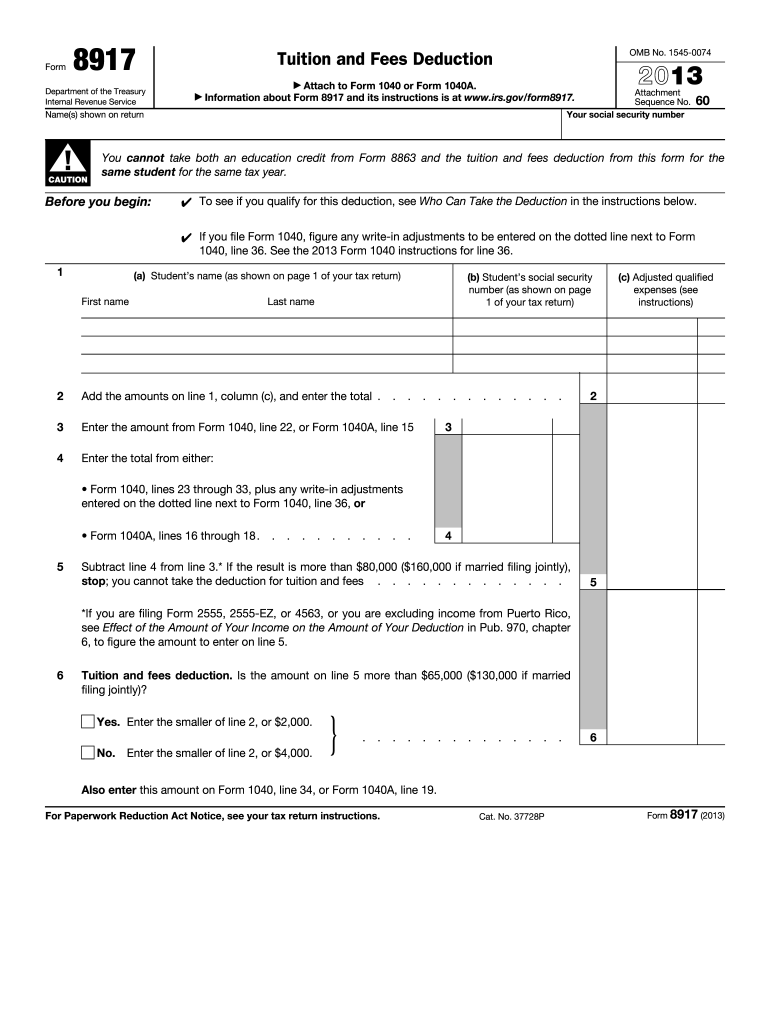

8917 form

Tuition and Fees Deduction is used to figure and take the deduction for tuition and fees expenses

Learn more

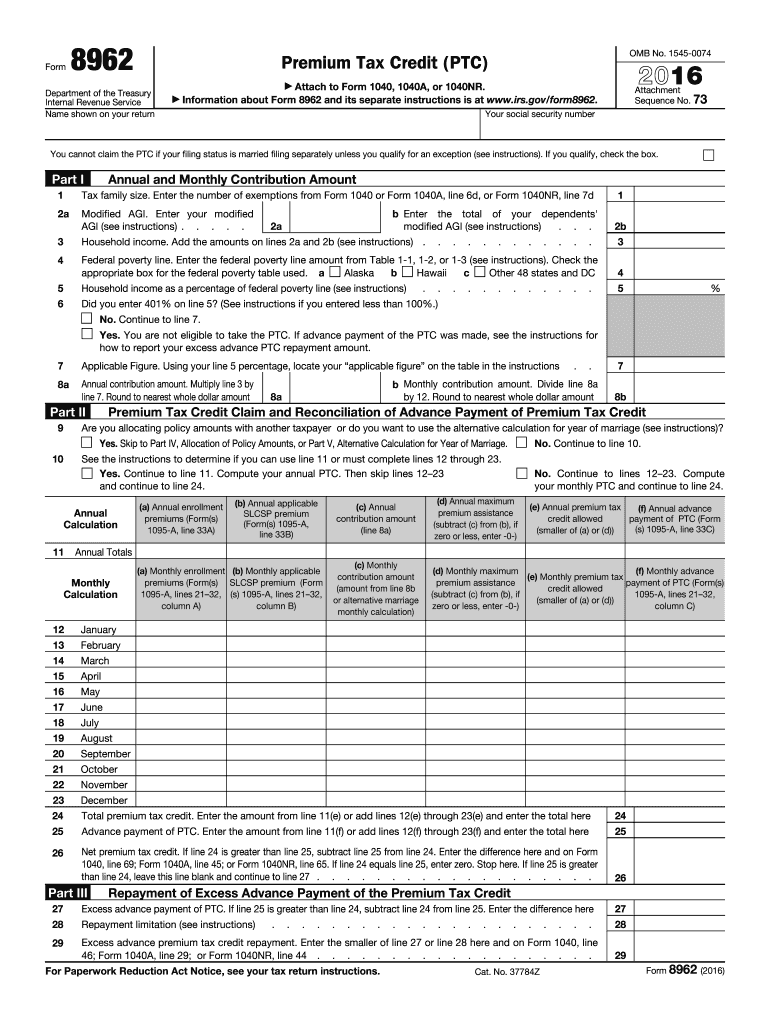

8962 form

Premium Tax Credit (PTC). Use this form to figure the amount of your premium tax credit (PTC)

Learn more

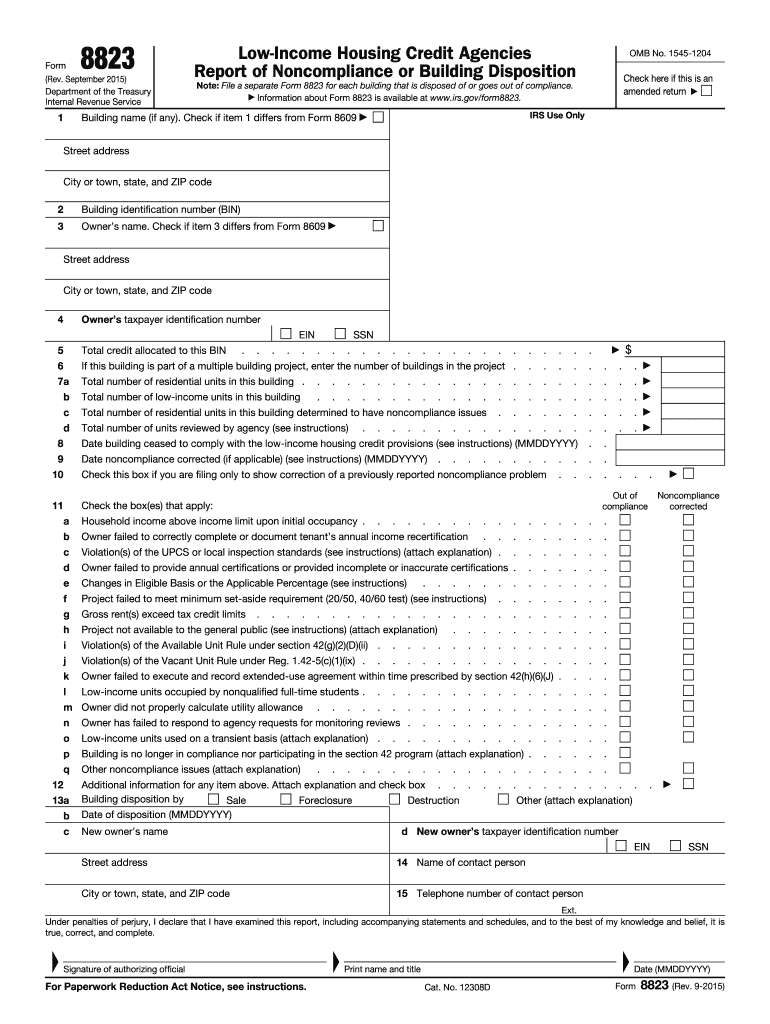

8823 form

Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition

Learn more

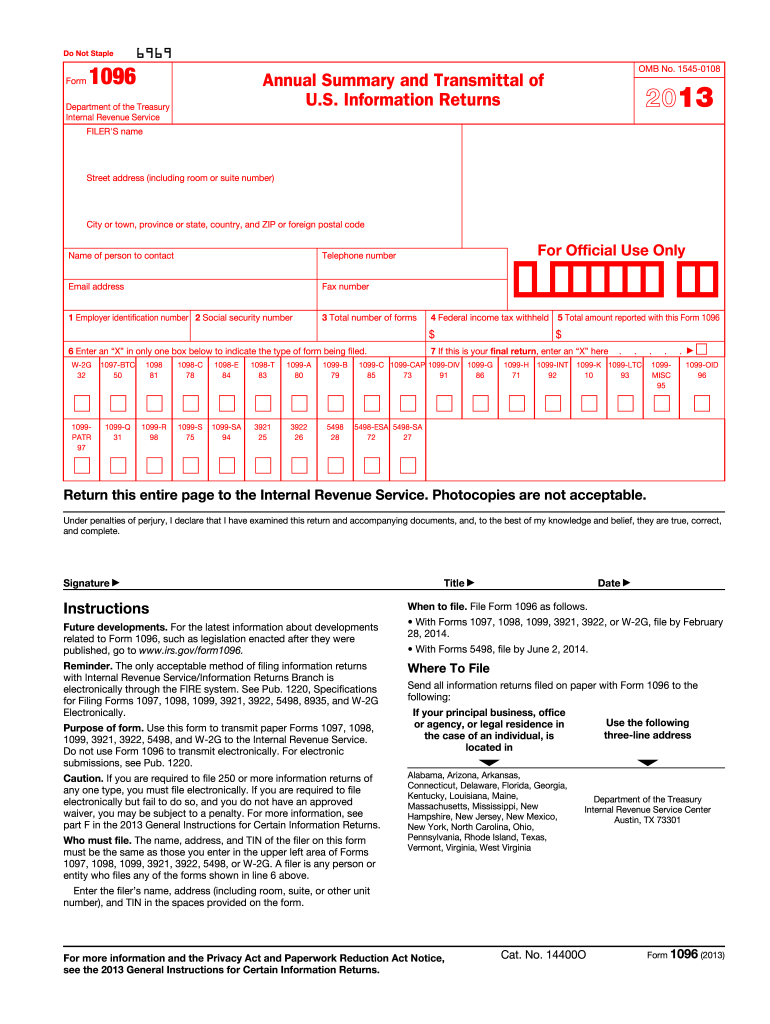

1096 form

Use this form to transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service.

Learn more

2441 forms

Child and Dependent Care Expenses are used when you pay someone to look after your child so you can work or look for work.

Learn more

Publication 3319

Publication 3319 outlines requirements for operating a qualified Low Income Taxpayer Clinic under Internal Revenue Code (IRC) § 7526.

Learn more